New Employer

An employer can be added to the system if there is not a current record of the employer in the system.

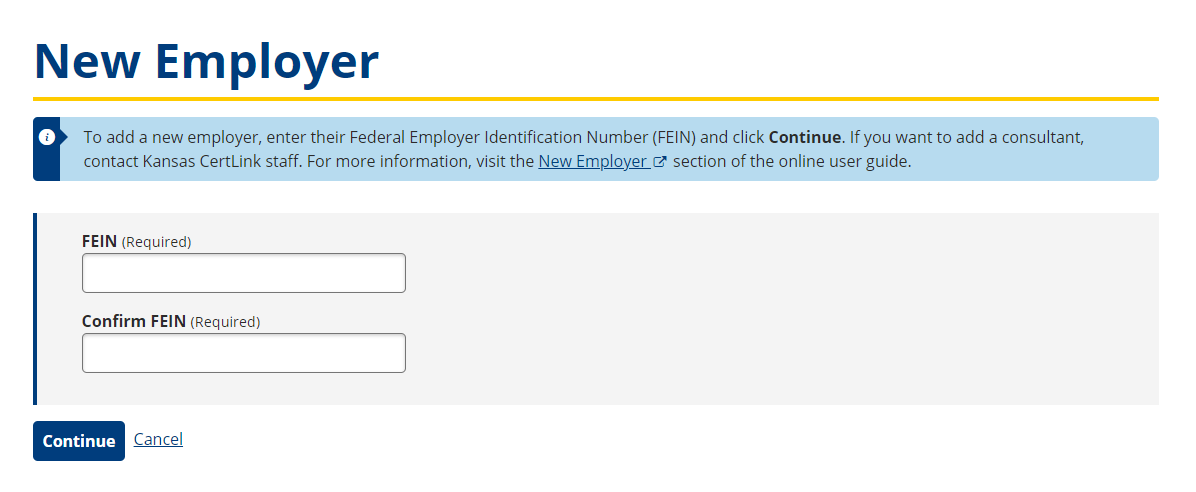

- Select New Employer from the side menu. The New Employer page displays.

- Enter the company’s Federal Employee Identification Number (FEIN) in the FEIN and Confirm FEIN fields.

- Select Continue.

- Complete the New Employer page. The table below provides descriptions of the fields listed on the New Employer page.

- Select Add New Employer to submit the new employer information to the State WOTC for approval.

- Account verification takes up to five business days. An email with the determination is sent to the email address provided.

| Field | Description |

|---|---|

| FEIN | This is automatically populated from the previous page. |

| Employer Name | Enter the name of the employer. |

| Is Non-Profit | Select the checkbox beside Is Non-Profit if the employer is a non-profit company. |

| Primary Address | |

| Address Line 1 | Enter the employer’s primary address. This is the default address for correspondence. |

| Address Line 2 | Enter the second line for the employer’s primary address, if applicable. This is the default address for correspondence. |

| ZIP | Enter the ZIP code for the employer’s primary address. |

| City | Enter the city for the employer’s primary address. |

| State | Select the state or Canadian province for the employer’s primary address from the drop-down list. |

| Country | Select the country for the employer’s primary address from the drop-down list. |

| Contact Information | |

| Title | Enter the title for the employer’s primary contact. |

| First Name | Enter the first name of the primary contact for the employer. |

| Last Name | Enter the last name of the primary contact for the employer. |

| Phone Number | Enter the primary phone number for the employer. |

| Fax Number | Enter the primary fax number for the employer. |

| Enter the primary email address for the employer. | |

| Preferred Contact Method | Select the Preferred Contact Method for the employer from the drop-down list. |